Discover how Paytm share price rebounded amidst regulatory hurdles, speculation of money laundering probes, and founder reassurances, reflecting the fintech giant’s resilience and strategic moves.

Paytm share price Rebounds

The rollercoaster ride of Paytm share price took a positive turn on February 6, bouncing back from a dramatic 42% drop over the past three trading days, sparked by regulatory restrictions from the RBI on its payments bank operations. The stock closed at Rs 451.15, marking a 2.9% increase for the day, though it peaked at Rs 473.55 earlier on.

During the trading session, Paytm share price soared by as much as 8%, breaking free from the lower circuit it had been stuck in for three consecutive sessions following the RBI’s clampdown. These restrictions include a ban on taking in new deposits and carrying out credit transactions after February 29.

Paytm’s Efforts to Address Regulatory Challenges

Despite this uptick, the stock remains down by a significant 41% over the past four trading sessions, plummeting from Rs 761.4. Vijay Shekhar Sharma, the company’s Managing Director, reportedly engaged with RBI officials earlier in the week, but no concrete progress was made on resolving the issues.

Adding to the company’s woes, there are speculations that the Enforcement Directorate (ED) might launch a probe into allegations of money laundering against Paytm. The company has denied facing any investigation from the ED.

Must Read

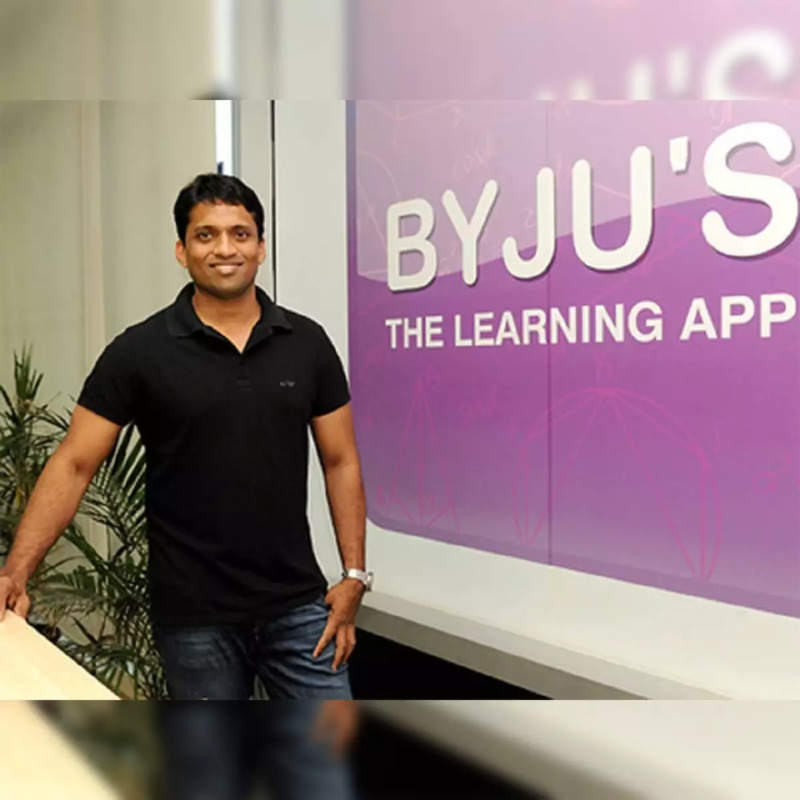

BYJU’S has paid January salaries-Raveendran committed to employees amid cash crunch

BYJU’S has paid January salaries-Raveendran committed to employees amid cash crunch

Apeejay Surrendra Park Hotels IPO Unveiled: A Hospitality Investment Opportunity or Paytm 2.0?

Apeejay Surrendra Park Hotels IPO Unveiled: A Hospitality Investment Opportunity or Paytm 2.0?

Brokerage Downgrades and Target Prices

Brokerages have revised their outlook on Paytm’s stock, slashing its target price. Jefferies now pegs it at Rs 500, while Macquarie lowered its target to Rs 650. While amidst the turbulence, Paytm attempted to address concerns by refuting reports of an impending ED investigation over money laundering allegations.

With Paytm’s stock price closing at Rs 438.5, well below both brokerage target prices, there’s a sense of uncertainty lingering.

In a bid to reassure its workforce amidst the turmoil, founder Vijay Shekhar Sharma assured that there would be no layoffs. The company is actively engaging with the RBI and exploring potential partnerships with other banks to navigate through the crisis.

Bhaarat Bulletin’s Shikha Rai and Bimal Dev have contributed to the above report