Discover the latest bombshell as RBI Governor Shaktikanta Das refuses to budge on the crackdown against Paytm Payments Bank! Get the inside scoop on the regulatory storm brewing and how it could impact your finances. Stay informed with our in-depth coverage!

RBI Stands Firm: No Reconsideration of Action Against Paytm

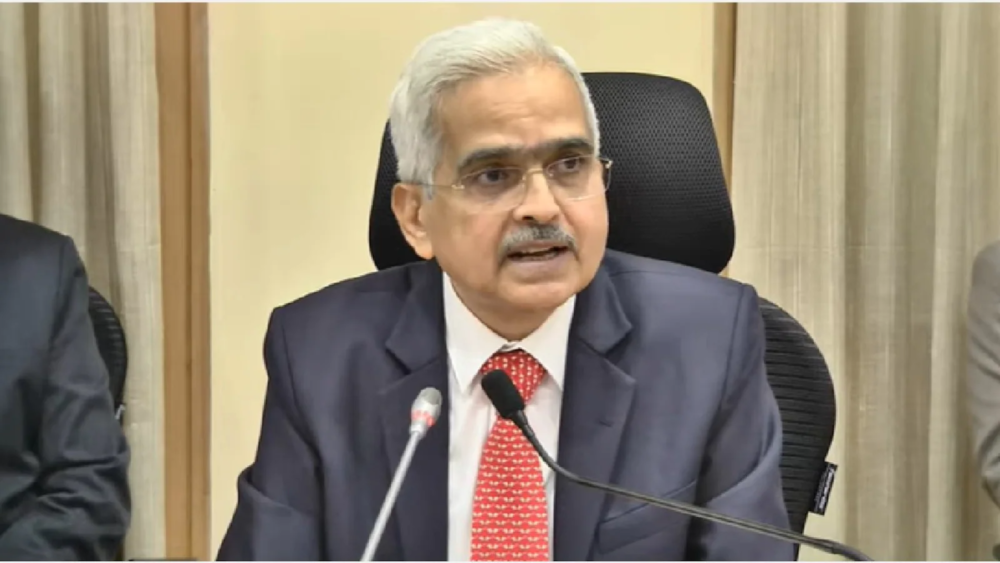

RBI Governor Shaktikanta Das made it clear on Monday that there won’t be any reconsideration of the central bank’s action against Paytm Payments Bank Ltd (PPBL). He stated that the decision to halt certain operations of PPBL was made after careful consideration and thorough analysis of the bank’s operations.

The RBI directed PPBL to cease accepting deposits or top-ups in various accounts and instruments after 29th February due to significant non-compliance with regulations and supervisory concerns.

During a press conference following a meeting of the RBI’s central board of directors, Das affirmed that there is no plan to review the decision. He emphasized that such actions are taken only after extensive analysis and in the best interest of the public.

Must Read

Paytm in Hot Water: The Untold Story of FDI Scrutiny – Are Big Changes on the Horizon?

Paytm in Hot Water: The Untold Story of FDI Scrutiny – Are Big Changes on the Horizon?

Xiaomi’s Shocking Revelation: Why Component Suppliers Fear India!

Xiaomi’s Shocking Revelation: Why Component Suppliers Fear India!

Customer Focus: RBI to Issue FAQs Addressing Paytm Concerns

Despite supporting the fintech sector, Das reiterated the RBI’s commitment to safeguarding customer interests and ensuring financial stability, the RBI plans to issue a set of FAQs regarding the Paytm issue to address customer concerns, with a focus on customer and depositor interests.

Regarding economic growth, Das expressed confidence in achieving the projected 7% GDP growth for FY25, attributing it to robust economic activity. He mentioned that the government’s fiscal consolidation efforts, reflected in reduced borrowings, could spur private-sector investment in the next fiscal year.

Regional Integration: UPI Linkage with Mauritius and Sri Lanka

Additionally, Finance Minister Nirmala Sitharaman launched the integration of India’s UPI system with fast payment systems in Mauritius and Sri Lanka. This initiative will enable users in both countries to conduct transactions using a QR code for merchant purchases and other activities. Banks in Mauritius will issue RuPay cards for digital payments and ATM withdrawals in both countries.

Bhaarat Bulletin’s Shikha Rai and RBI have contributed to the above report