Discover the shocking truth behind the RBI’s ban on gold loans and its impact on IIFL Finance. Dive deep into the regulatory battle, uncovering hidden scandals and investor panic. Don’t miss this exclusive inside story revealing the dark secrets of IIFL Finance’s governance probe!

Addressing Investor Concerns

IIFL Finance Ltd took steps to reassure investors on Tuesday, emphasizing that there were no governance lapses despite the Reserve Bank of India (RBI) barring the company from offering loans against gold.

Investors reacted strongly, with shares of IIFL Finance plummeting by 20% on Tuesday morning following the news of the RBI’s statement outlining certain lapses.

Must Read

Breaking: JM Financial Slapped with RBI Ban – What You Need to Know!

Breaking: JM Financial Slapped with RBI Ban – What You Need to Know!

Money Moves Alert: JG Chemicals IPO – Your Ticket to Wealth Creation!

Money Moves Alert: JG Chemicals IPO – Your Ticket to Wealth Creation!

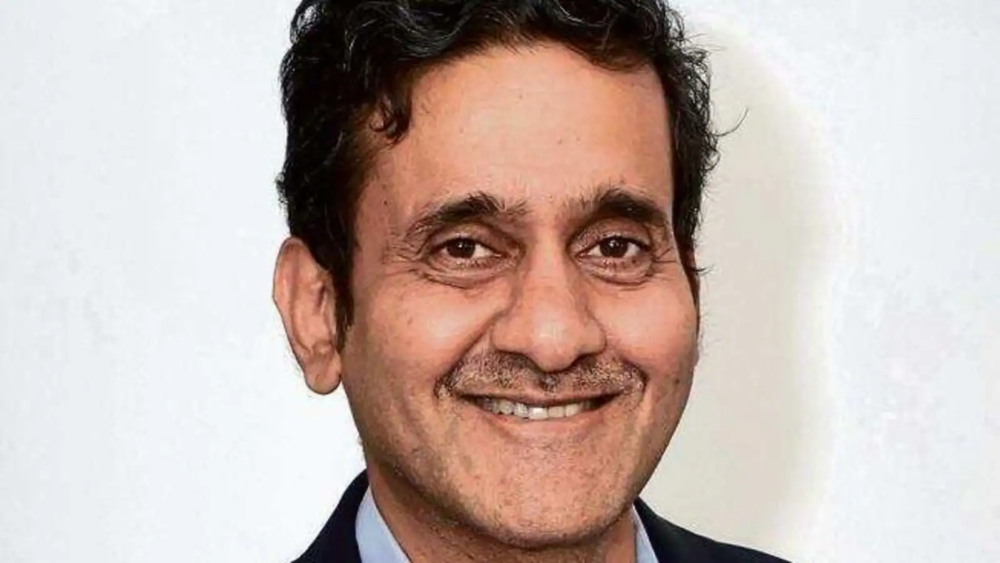

Statement by IIFL MD

Nirmal Jain, the managing director of IIFL Finance, personally reached out to analysts on Tuesday to convey that there were no governance or ethical issues. He wanted to make it clear that the concerns raised were more operational and pledged immediate and comprehensive steps to address them.

The RBI’s highlighting of breaches in the loan-to-value ratio raised eyebrows, questioning whether IIFL’s assessment of gold value before granting loans was accurate. This led to concerns about aggressive sales tactics, with worries that sales executives might have overvalued gold to provide larger loans.

IIFL Finance Gold Loan Portfolio

The growth in IIFL’s dedicated gold-loan branches over the past 30 months indicates significant expansion, particularly in regions like Gujarat, Maharashtra, and Goa. The total gold loans disbursed reached ₹24,692 crore by the end of December 2023, contributing to the company’s total assets under management of ₹77,444 crore.

Despite RBI guidelines allowing loans up to 90% of the gold’s value, there were concerns about IIFL’s internal audit approach. Jain clarified that the company’s audit team takes a conservative stance, particularly when assessing loans turning into non-performing assets.

IIFL Finance revealed that it began engaging with RBI management in the past 45 days after receiving comments on the 2022-23 inspection report in January 2024.

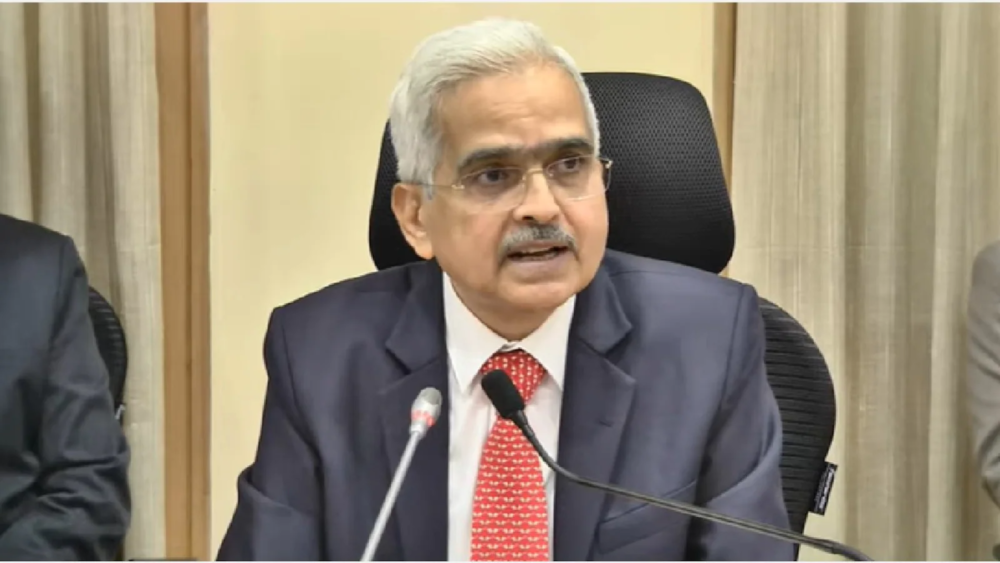

Regulatory Action by RBI

RBI’s official release mentioned engaging with IIFL’s senior management and statutory auditors for several months before taking regulatory action due to perceived inaction.

IIFL assured that corrective actions have been implemented to minimize differences between branches and the audit team. However, challenges remain, particularly regarding the profitability growth of the company with no new gold loan disbursements.

Despite the reassurances, some analysts expressed concerns, noting that the absence of new gold loan disbursements could impact profitability, given that gold loans represent a significant portion of the company’s business division.

Bhaarat Bulletin’s Shikha Rai, Bimal Dev, and IIFL Finance, BSE, and NSE have contributed to the above report