Hyundai IPO-Explore Hyundai’s remarkable journey in the Indian automotive landscape spanning nearly three decades. Uncover the latest reports on a potential game-changing Hyundai (IPO) Initial Public Offering in India, aiming to rewrite IPO history with a valuation of $22-28 billion this Diwali.

Hyundai made its debut in India about thirty years ago, and since then, the South Korean automaker has grown to be a major player in the Indian automotive industry. According to recent speculations, Hyundai may be considering a ground-breaking decision: an Initial Public Offering (IPO) in India. This prospective Hyundai IPO has the potential to become the largest in India, surpassing the mark set by LIC. With its steady expansion, innovative products, and strategic market approaches, Hyundai has established itself as India’s second-largest seller of passenger vehicles, behind only Maruti Suzuki.

Hyundai IPO: A Game-Changing Move

Industry sources claim that Hyundai IPO in India has the potential to revolutionize the equities market in that nation. Hyundai, the country’s second-biggest seller of passenger cars behind Maruti Suzuki, hopes to gain a substantial foothold in the industry with this calculated effort. If this IPO is successful, it might reinvent the history of initial public offerings (IPOs) in India and possibly break new records, with reports predicting a valuation ranging from 23 billion-28 billion.

Global Perspective: Aligning with South Korea’s ‘Value-Up’ Program

In addition to being an important turning point in the company’s history, Hyundai’s prospective IPO in India would also be a historic development for the country’s financial scene. Hyundai is reaching new heights as a result of its creative products, growth-oriented strategy, and ability to handle the intricacies of the Indian market. The upcoming Hyundai IPO may constitute a turning point in the history of both Hyundai and the Indian equities market, determining their respective future paths.

Financial Landscape: Hyundai’s Growth Targets and Investment Plans

Hyundai has goals beyond the initial public offering (IPO), with a target growth in sales of 4% to 5% by 2024. This year, the company intends to invest a total of USD 10 Billion, of which USD 5.6 Billion would be allocated to capital expenditures and USD 4.9 Billion to research & development. Hyundai’s dedication to product development, technological breakthroughs, and general market expansion is demonstrated by this large expenditure.

Hyundai’s potential IPO in India signifies not only a significant milestone in the company’s journey but also a landmark event in India’s financial landscape. As Hyundai navigates the complexities of the Indian market, its strategic vision, innovative products, and commitment to growth continue to propel the company toward new heights. The forthcoming IPO could be a defining moment, not just for Hyundai but for India’s equity market, shaping the future trajectory of both.

Must Read

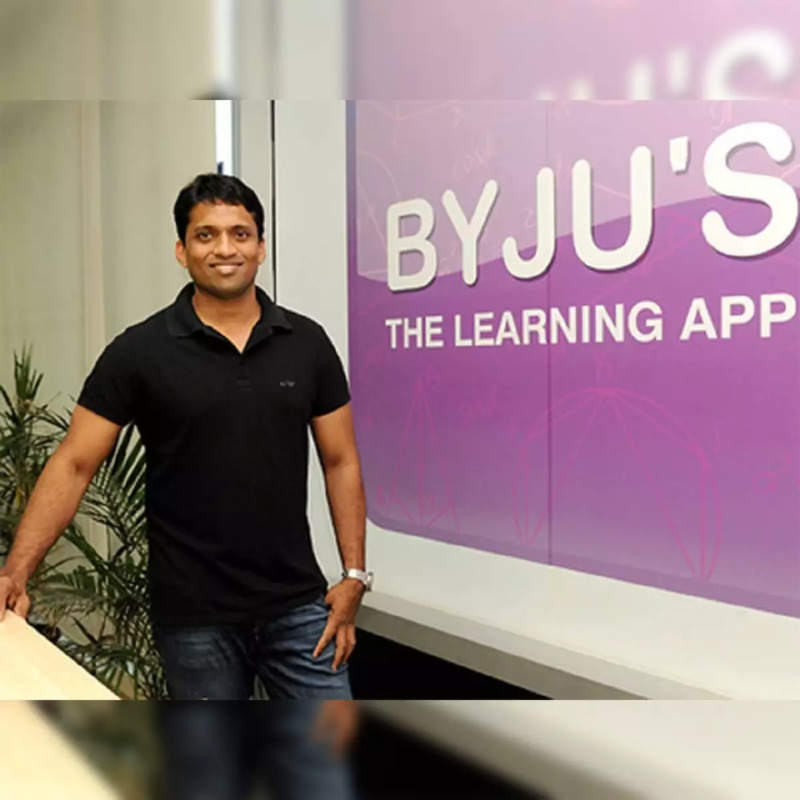

BYJU’S has paid January salaries-Raveendran committed to employees amid cash crunch

BYJU’S has paid January salaries-Raveendran committed to employees amid cash crunch

Apeejay Surrendra Park Hotels IPO Unveiled: A Hospitality Investment Opportunity or Paytm 2.0?

Apeejay Surrendra Park Hotels IPO Unveiled: A Hospitality Investment Opportunity or Paytm 2.0?

Bhaarat Bulletin’s Shikha Rai and Bimal Dev have contributed to the above report