Discover the shocking reason behind IIFL Finance’s 20% nosedive! Get the inside scoop on why the RBI’s crackdown on gold loans has investors sweating bullets.

IIFL Finance Share Price Takes a Hit Following RBI Ban

Investors were left reeling on Tuesday, March 5, as shares of IIFL Finance plunged by a staggering 20 percent on the Bombay Stock Exchange (BSE), settling at Rs 478.5 per share. The sudden drop came in the aftermath of the Reserve Bank of India’s (RBI) stringent measures against the company. The RBI, in a move to address significant concerns, prohibited IIFL from sanctioning or disbursing gold loans, as well as from transferring, securitizing, or selling any of its gold loan assets.

Must Read

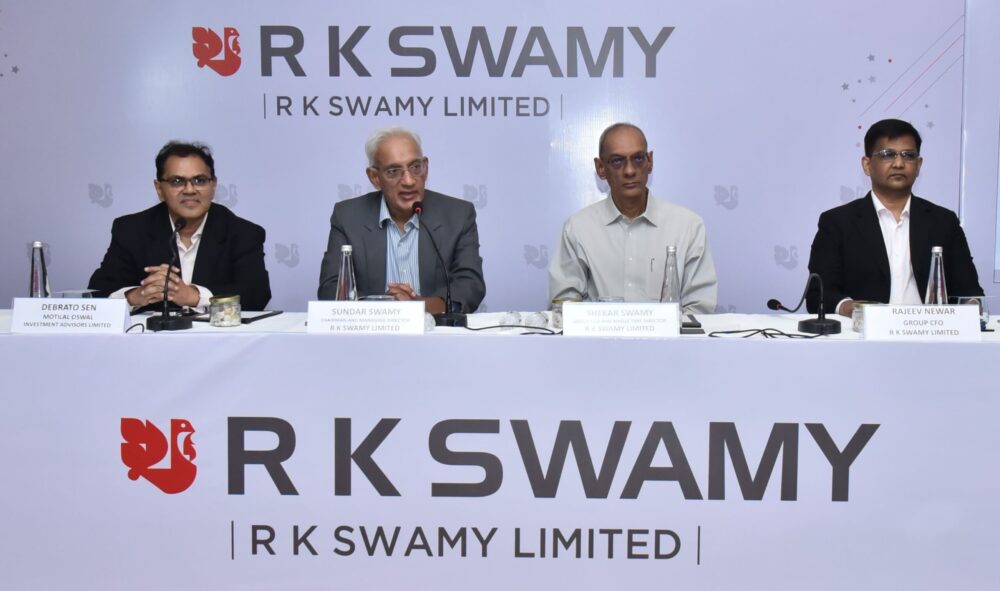

Don’t Miss Out! RK Swamy IPO: Your Ticket to Profit?

Don’t Miss Out! RK Swamy IPO: Your Ticket to Profit?

Don’t Miss Out! Mukka Proteins IPO Subscribed 136.87 Times – Check Your Allotment Status Today!

Don’t Miss Out! Mukka Proteins IPO Subscribed 136.87 Times – Check Your Allotment Status Today!

Understanding the RBI’s Decision

The RBI’s decision to crack down on IIFL stemmed from its thorough examination of the company’s financial standing. During this scrutiny, alarming issues surfaced regarding the integrity of IIFL’s gold portfolio. The RBI uncovered serious discrepancies in the evaluation of gold purity and weight both at the time of loan approval and during the auction process following defaults. Additionally, the central bank flagged other irregularities, such as excessive cash transactions surpassing statutory limits, deviations from standard auction protocols, and opacity in the imposition of charges on customer accounts.

These findings not only raised regulatory concerns but also highlighted the potential harm to customer interests, prompting the RBI to take decisive action.

With immediate effect, IIFL found itself constrained by the RBI’s directive. However, the RBI clarified that while the company could no longer issue new gold loans, it could still manage its existing gold loan portfolio through regular collection and recovery mechanisms.

A Deep Dive into IIFL Finance’s Gold Loan Portfolio

An analysis conducted by Zee Business Research revealed that the IIFL gold loan segment accounted for a significant 32 percent of its overall portfolio. As of December 31, the value of the company’s gold loan assets stood at a substantial Rs 24,700 crore. Moreover, IIFL had established partnerships with 7 to 8 banks for its gold loan operations, including prominent names such as DSB Bank, Canara Bank, Union Bank, UCO Bank, South Indian Bank, Karur Vysya Bank, Shivalik Small Finance Bank, and IDBI Bank.

IIFL’s Response and Approach to Addressing the Ban

During a candid conference call with investors, IIFL management sought to reassure stakeholders by attributing the issue primarily to procedural and operational shortcomings, rather than ethical lapses in the administration of gold loans. The company pledged to furnish a comprehensive report to the RBI in the forthcoming days and expressed its willingness to undergo a special audit to address the concerns raised. While the management asserted that there would be no immediate adverse impact on the company’s financial health, they acknowledged that unresolved issues could potentially lead to future repercussions.

Additionally, the management moved to dispel any misconceptions, emphasizing that the RBI had not imposed any monetary penalties on the company.

Over the past year, investors in IIFL have witnessed a rollercoaster ride. While the company’s stock managed to eke out a modest gain of just over 5 percent, it paled in comparison to the Nifty50 index’s robust surge of over 26 percent during the same period.

Bhaarat Bulletin’s Shikha Rai, Bimal Dev, and BSE, NSE have contributed to the above report

Also Read