Discover the jaw-dropping success story of Hindalco Industries, the Aditya Birla Group’s flagship company. With a staggering 71% surge in profits and groundbreaking advancements in renewable energy. Dive into this must-read article to uncover the secrets behind Hindalco’s unprecedented achievements and learn how they’re shaping the future of sustainable energy.

Hindalco’s Impressive Financial Performance

Hindalco Industries has some impressive news to share. In the last quarter of December, their consolidated net profit soared by a whopping 71 percent compared to the same period last year, reaching Rs 2,331 crore.

Despite this impressive profit surge, the consolidated revenue dipped slightly by 0.6 percent year-on-year to Rs 52,808 crore, as mentioned in the company’s filing to the exchange on February 13.

Furthermore, the EBITDA for the aluminum upstream business witnessed a significant surge of 54 percent compared to the same period last year. This increase was attributed to stable operations and lower costs of raw materials, positioning the company in the top quartile of the global cost curve, as mentioned by Pai.

The company reported an EBITDA of Rs 2,443 crore in the last quarter, a notable jump from Rs 1,591 crore in the corresponding period of the previous year.

Must Read

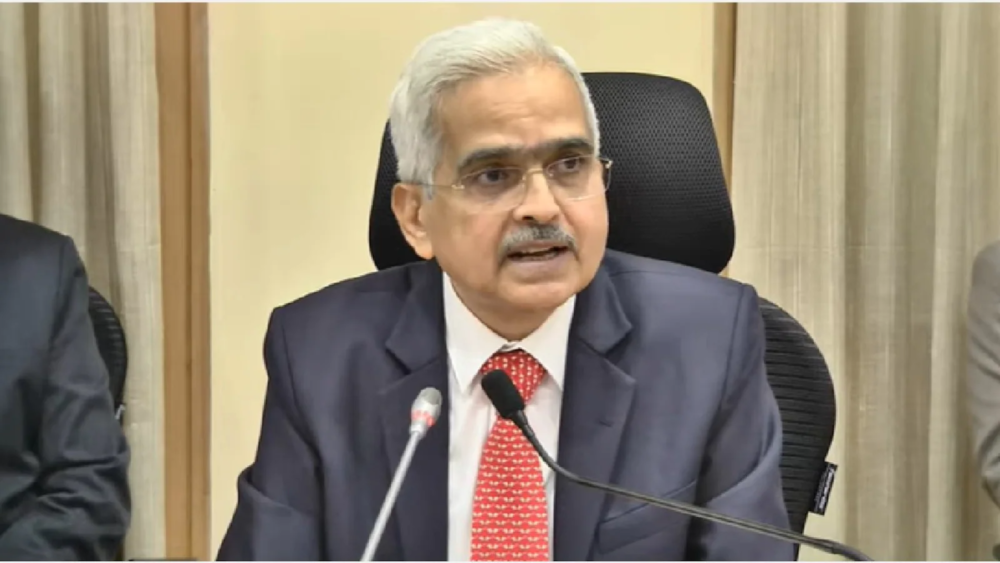

Shocking: Paytm Payments Bank Faces Shaktikant Das’ Wrath – Here’s the Inside Scoop!

Shocking: Paytm Payments Bank Faces Shaktikant Das’ Wrath – Here’s the Inside Scoop!

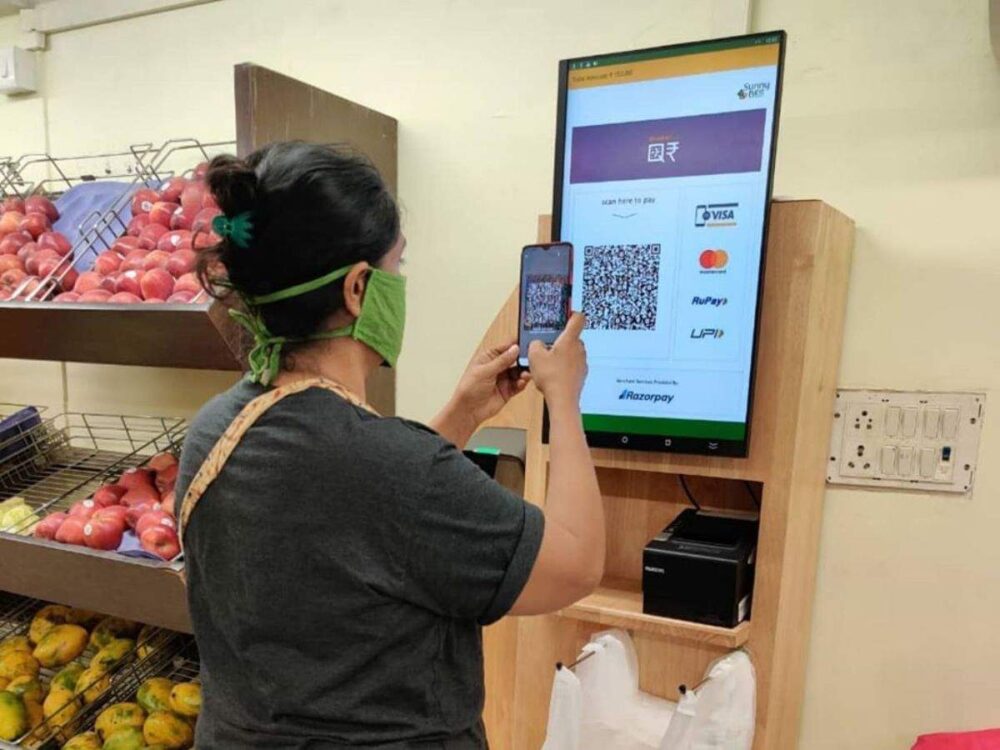

From India to the World: UPI Services Expand to Sri Lanka and Mauritius!

From India to the World: UPI Services Expand to Sri Lanka and Mauritius!

Challenges in Revenue Growth

While revenue from the copper business witnessed a healthy growth of 16 percent year-on-year to Rs 11,954 crore driven by higher sales volumes and prices, revenue from aluminum upstream saw a slight decline of 0.9 percent to Rs 7,971 crore.

However, despite these positive developments, the stock faced a setback, trading at Rs 510.90 on the NSE, down by 12.28 percent from the previous close. The decline was attributed to the revision of guidance for the cost of the Bay Minette project by Hindalco’s US-based subsidiary, Novelis.

Novelis announced on February 12 that the costs for the Bay Minette project would escalate by 65 percent, with a one-year delay in completion. The project’s cost is now estimated at $4.1 billion, with commissioning expected by the calendar year 2026 or in the second half of FY27.

Novelis’ Financial Highlights and Projections

Despite this setback, Novelis reported an impressive 81 percent rise in adjusted net income to $174 million and a 33 percent surge in adjusted EBITDA to $454 million. Devinder Ahuja, the executive vice president and CFO of Novelis Inc., expressed optimism, anticipating a return to a sustainable level of adjusted EBITDA per tonne of $525 starting from the current fiscal fourth quarter.

Nevertheless, Novelis experienced a 6 percent decline in sales compared to the previous year, amounting to $3.9 billion, driven by lower average aluminum prices despite consistent shipment levels.

Bhaarat Bulletin’s Shikha Rai, Bimal Dev, and Hindalco have contributed to the above report